ADAM BERGMAN IS A CRYPTO IRA TAX EXPERT

ADAM BERGMAN FOUNDED THE IRA FINANCIAL GROUP & IRA FINANCIAL TRUST COMPANY

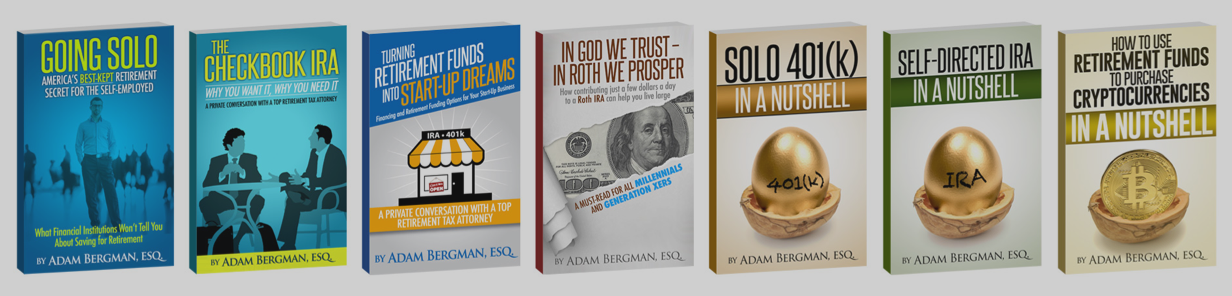

He’s published 7 books on the topic of retirement plans and taxation, including the first published book on how to use retirement funds to purchase cryptocurrencies (How To Use Retirement Funds to Purchase Cryptocurrencies in a Nutshell). He is a frequent contributor to Forbes, has been quoted in over 250 major publications, and helped over 12,000 clients establish self-directed retirement plans to make alternative asset investments.

Prior to founding the IRA Financial Group and IRA Financial Trust Company, leading providers of self-directed IRA & 401(k) plans for alternative asset investments, he worked as a tax and ERISA attorney at some of the world’s most prestigious law firms, such as White & Case LLP. Adam is a long-time cryptocurrency investor and a passionate advocate for the powers of blockchain technology.

He’s currently working on several exciting new projects, including a video series and a documentary on the cryptocurrency craze and retirees. He recently launched his podcast, Adam Bergman Talks.

ADAM HAS BEEN FEATURED IN

READ THE ARTICLES

Reg A And Reg D: What They Mean For Your Self-Directed IRA

August 12, 2021

The History Of The Self-Directed IRA

July 14, 2021

Backdoor Roth IRA Vs. ‘Mega Backdoor’ Solo 401(k)

June 17, 2021

LISTEN TO THE PODCAST

Blockchain 101 With Ken Gendrich

In this episode of Adam Talks, IRA Financial’s Adam Bergman Esq. is joined by certified blockchain architect, and founder of Token Foundry, Ken Gendrich, to explain the cutting edge technology behind cryptocurrency and other popular projects.

READ WHAT ADAM HAS TO SAY ON THE IRAFG BLOG

Price of Gold Soars – Buffett Bets On It

Warren Buffett is famous for his investing prowess, and part of that has been a reluctance to invest in gold. But now, Berkshire Hathaway is putting its power behind Barrick Gold Corp., of Canada, betting on the price of gold soaring…

3 Ways To Help Save Money

With tax returns just due and payments made, it can be difficult to think about saving up for the future, but these 3 ways to help save money can make a big difference. Reeling from tax payments and COVID-19 expenses, the lack of funds due to situations in the world can make you feel like you don’t have enough money for the future or for the now…

READ THE BOOKS